New Updates

FUEL HEDGING & NATURAL GAS MARKET UPDATE (February 2, 2026)

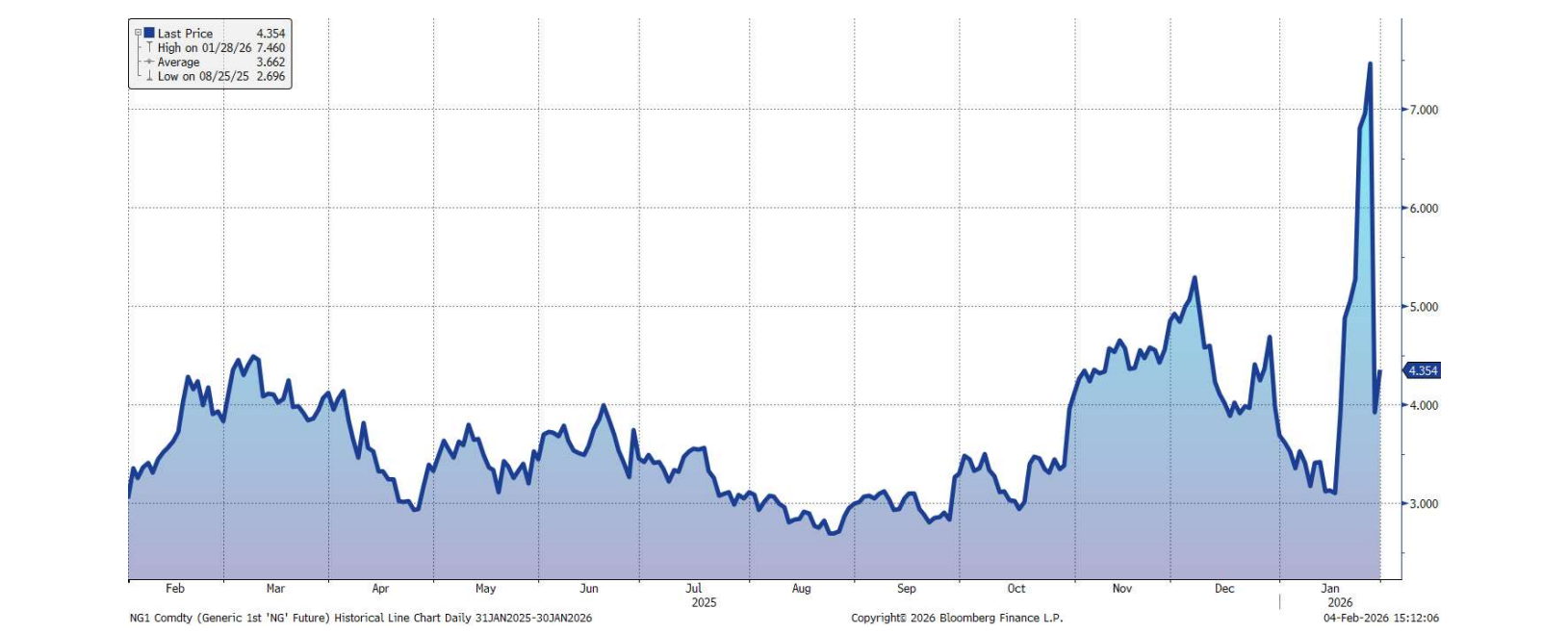

PRICES SPIKE HIGHER – INVENTORIES LOWER VS. FIVE-YEAR AVERAGE AND LOWER VS. EXPECTATIONS – PRODUCTION LOWER – DEMAND HIGHER EXPORTS LOWER – RIG COUNT HIGHER – HEDGE FAVORABILITY LOWER

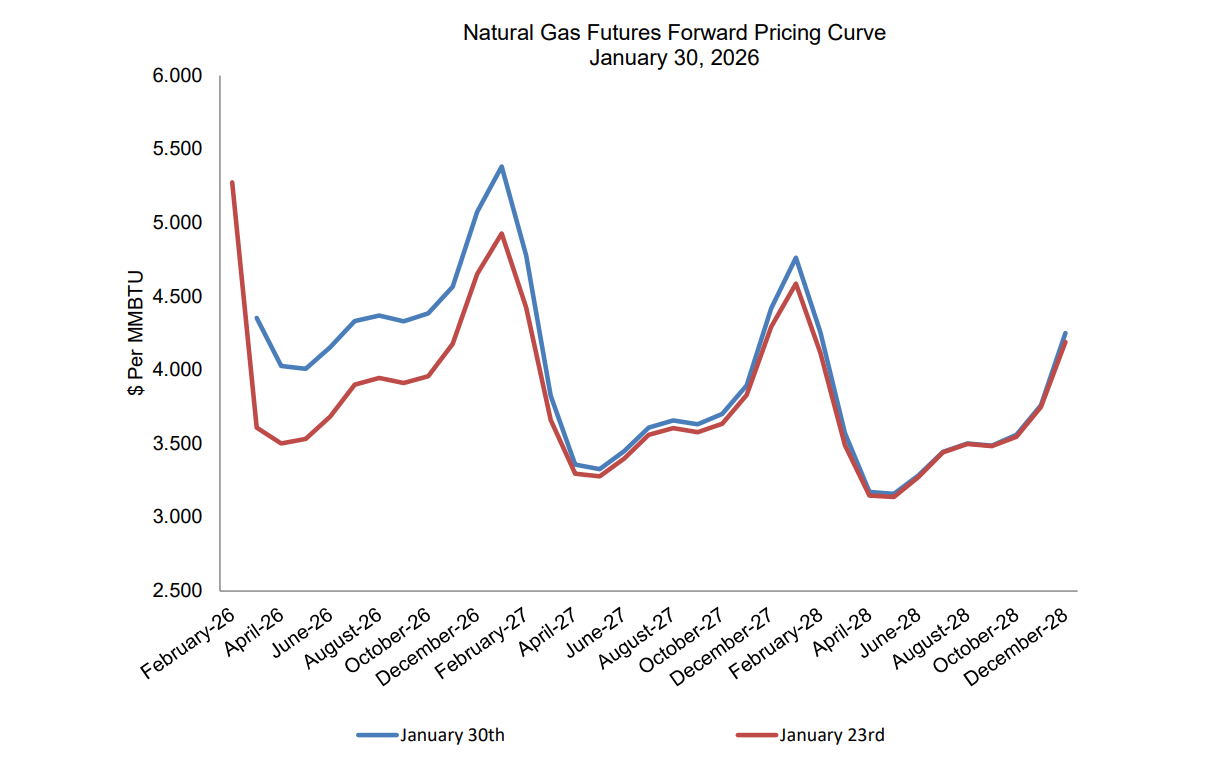

Price Movement:

- Spot price increased by $0.745 per MMBTU (+20.64%)

- Forward price increased by $0.057 per MMBTU

Key Drivers:

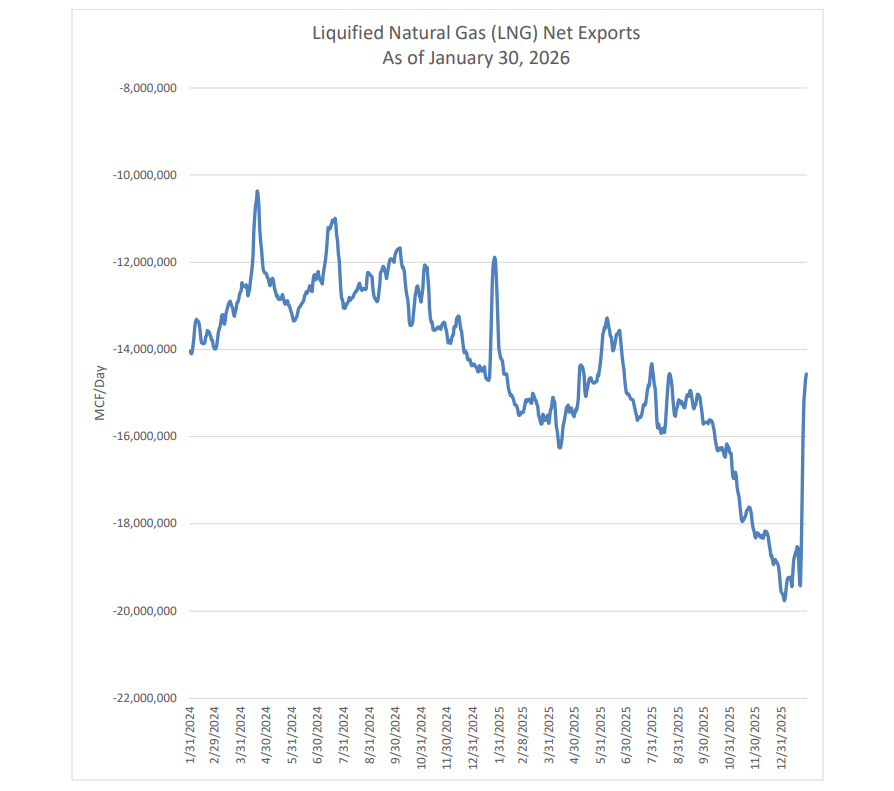

- Exports: Decreased, providing downward pressure on prices.

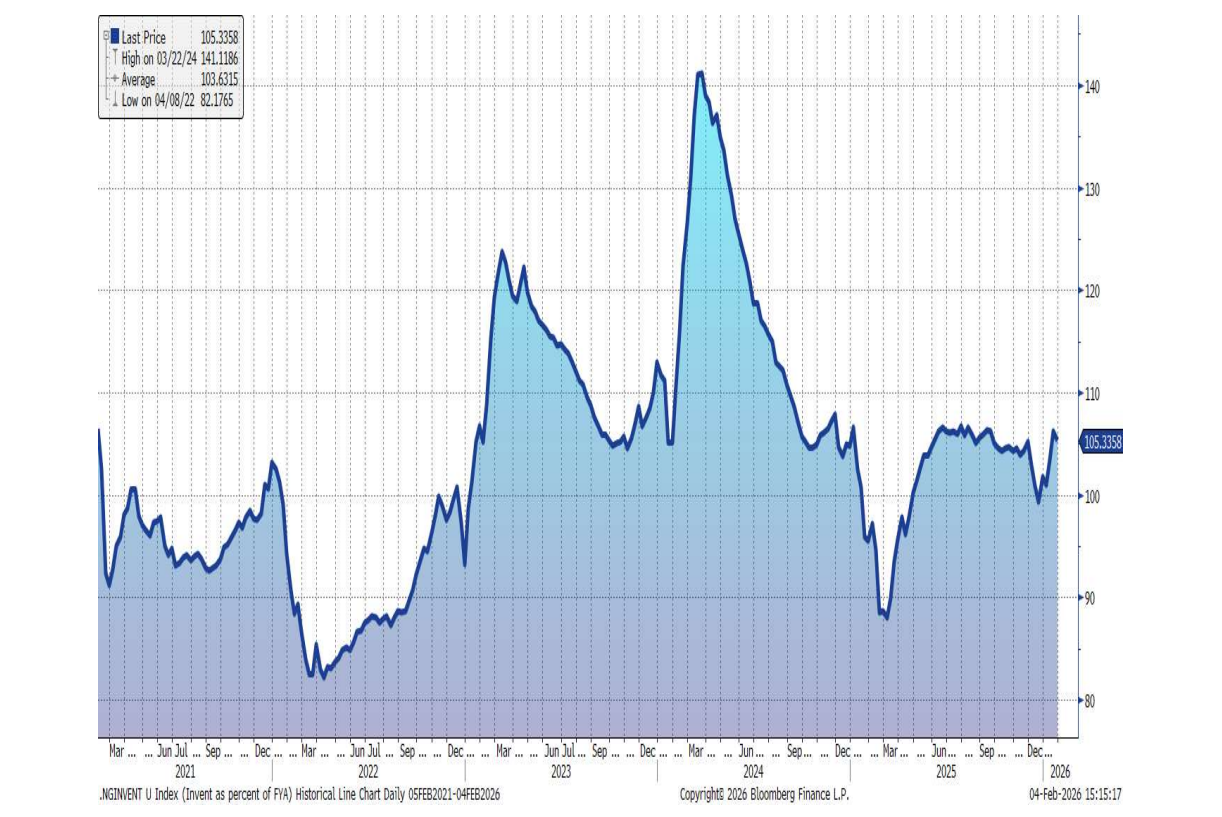

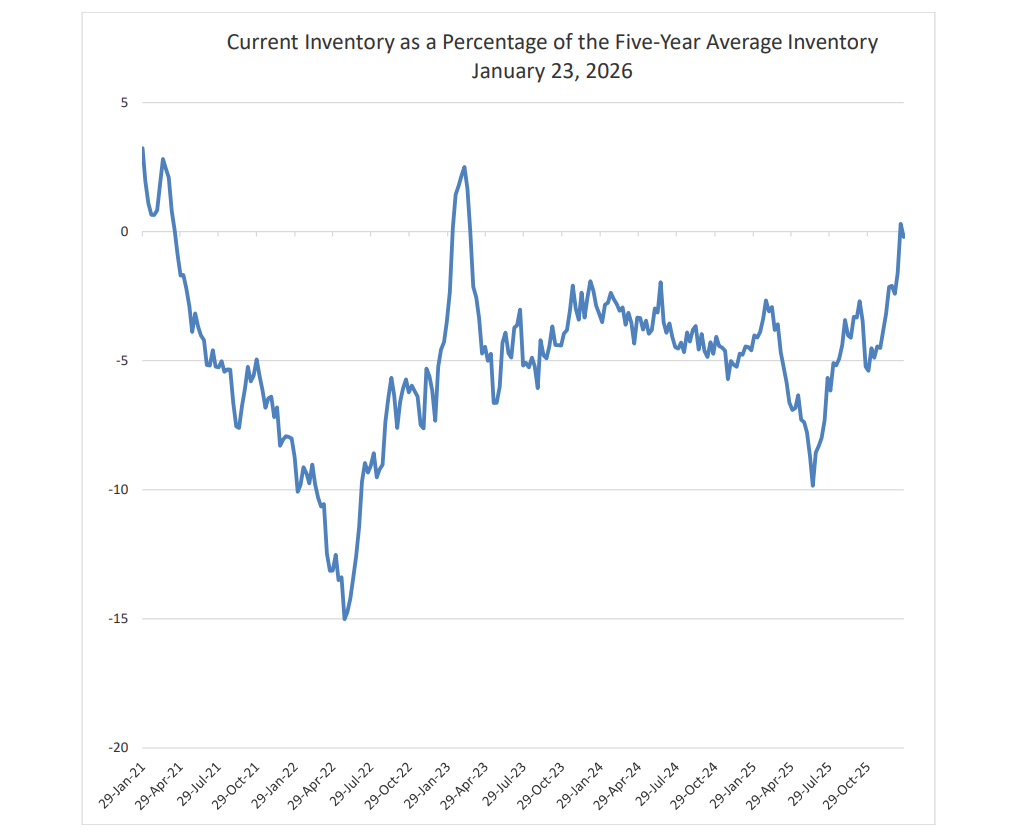

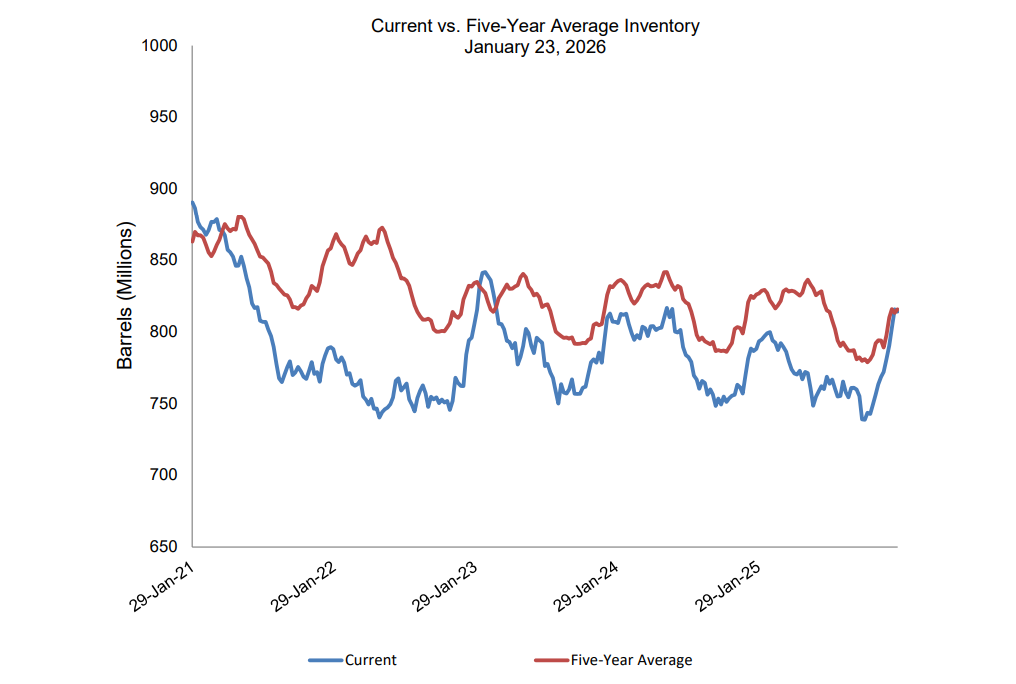

- Inventories: Decreased compared to expectations, positive for prices.

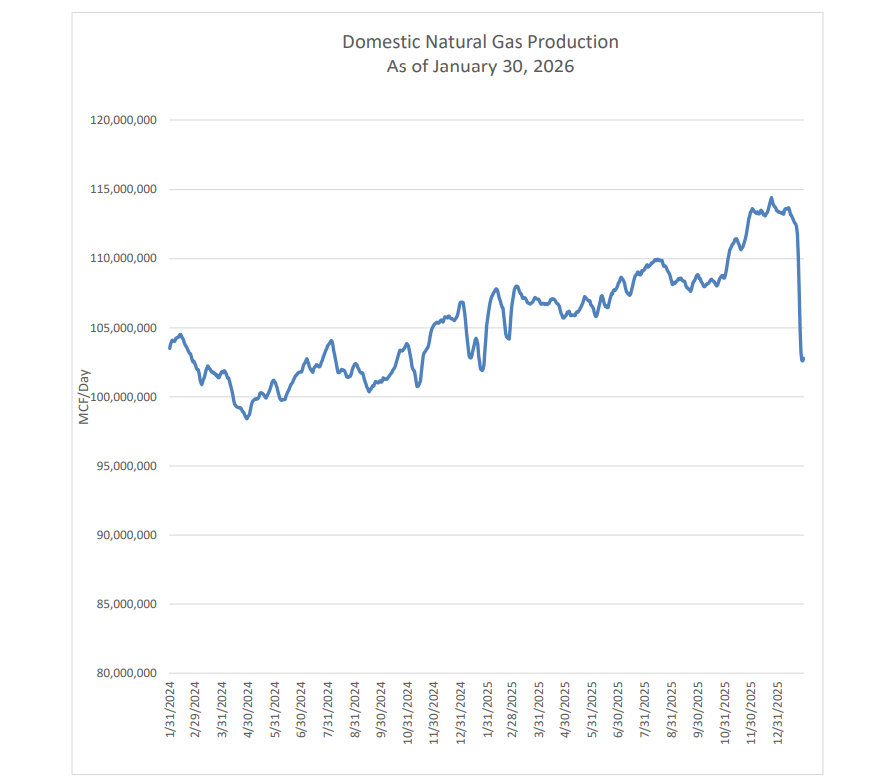

- Production: Lower for the week, supporting higher prices.

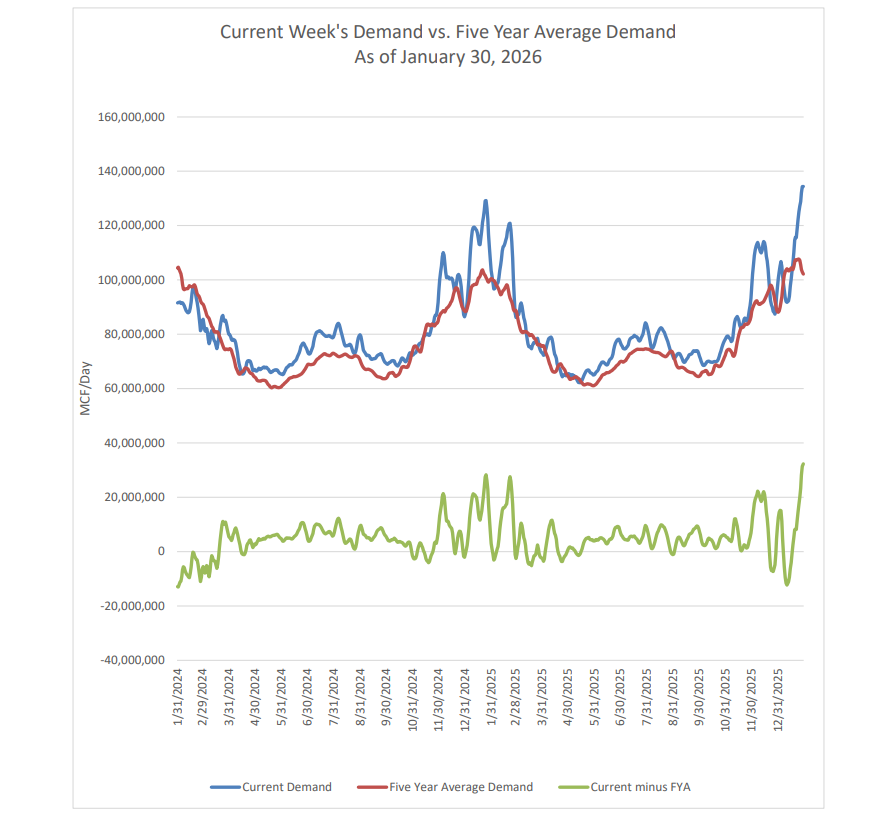

- Demand: Increased due to colder temperatures, significantly driving up prices.

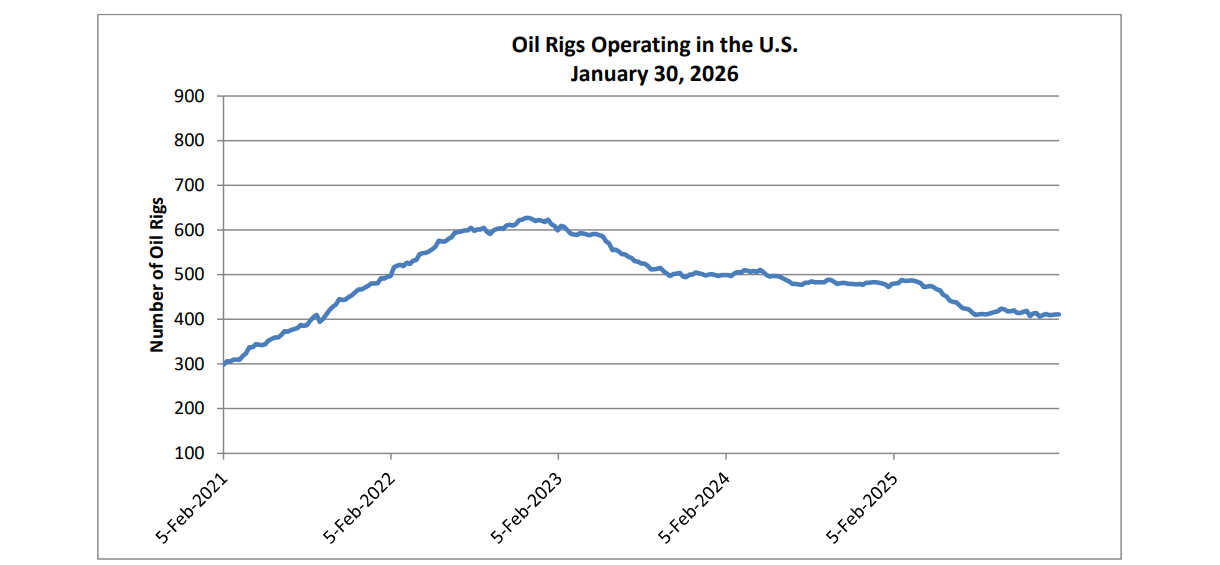

- Rig Count: Increased slightly, which is negative for prices.

Market Indicators:

- Hedge Favorability Index: Decreased to 21.59%, down from 22.81%, showing less favorable conditions for hedging.

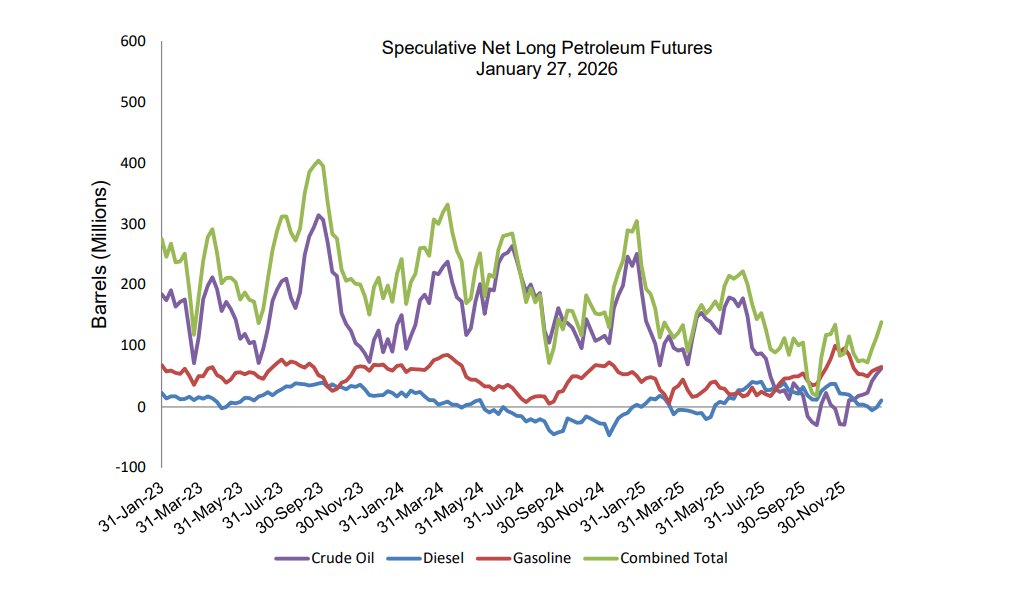

- Speculation: Increased for the week, which supports higher prices.

Forecast:

- The cold weather and high demand will likely continue creating volatility in prices, especially with LNG exports lower and inventories tightening.

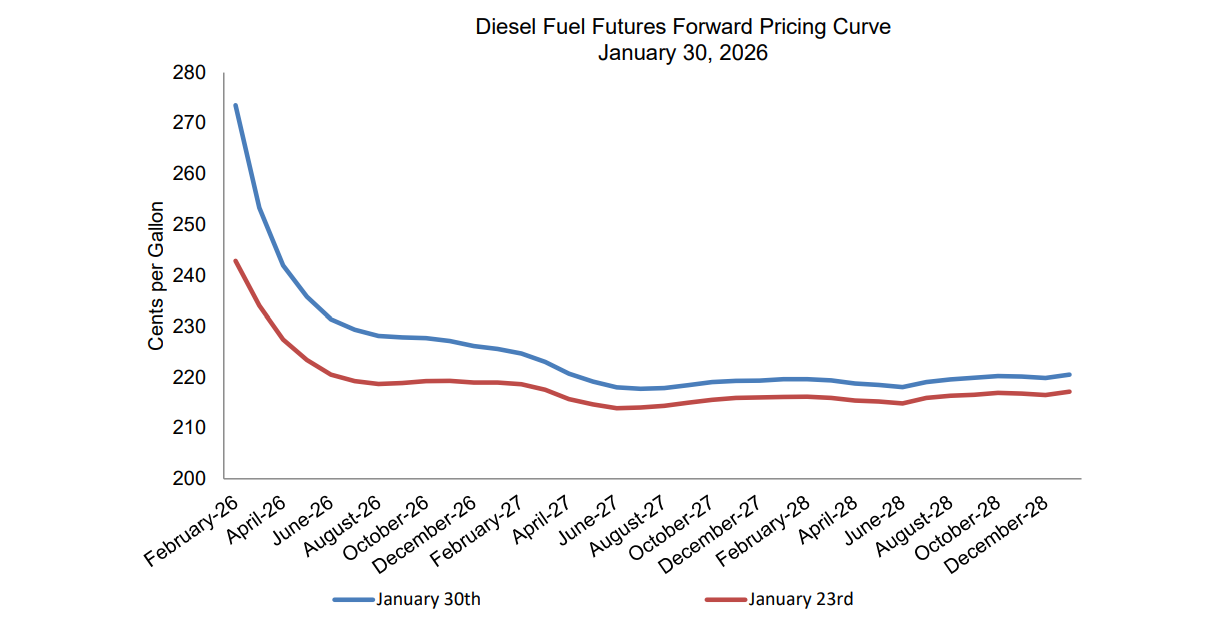

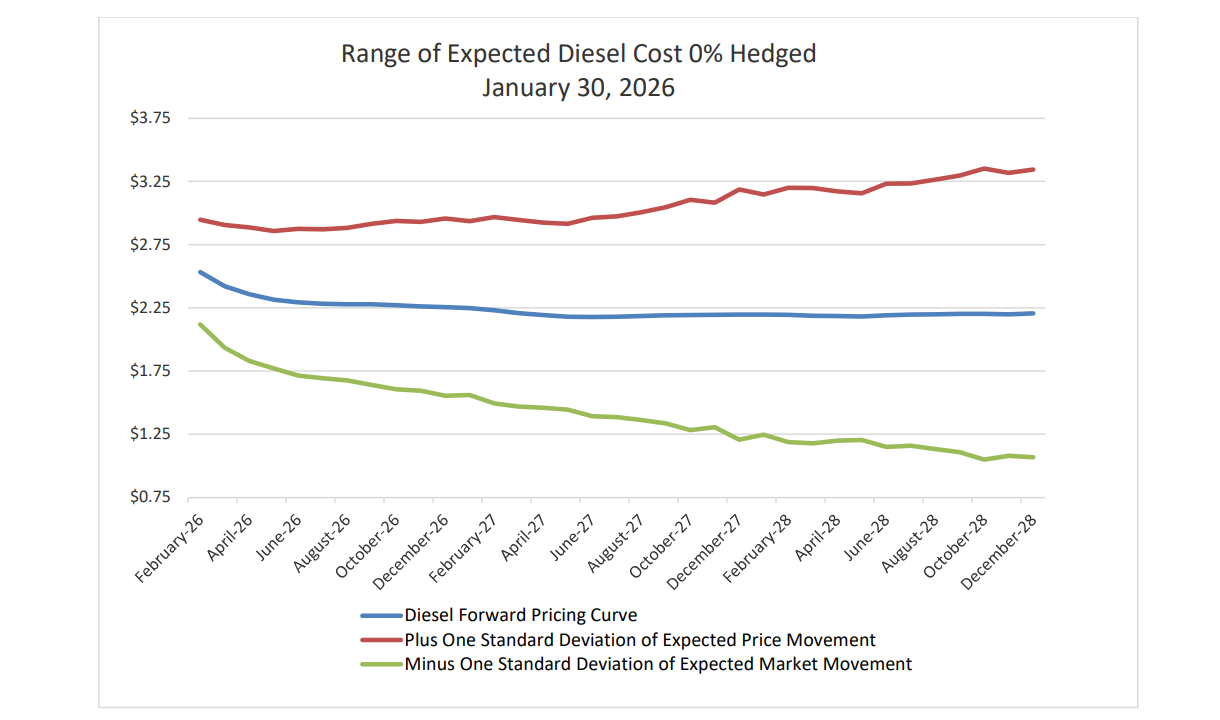

FUEL HEDGING & PETROLEUM MARKET COMMENTARY (February 2, 2026)

PRICES HIGHER – CRUDE OIL PRODUCTION LOWER – INVENTORY LOWER - DOLLAR LOWER – STOCK MARKET HIGHER – SPECULATION HIGHER - DEMAND HIGHER – HEDGE FAVORABILITY LOWER

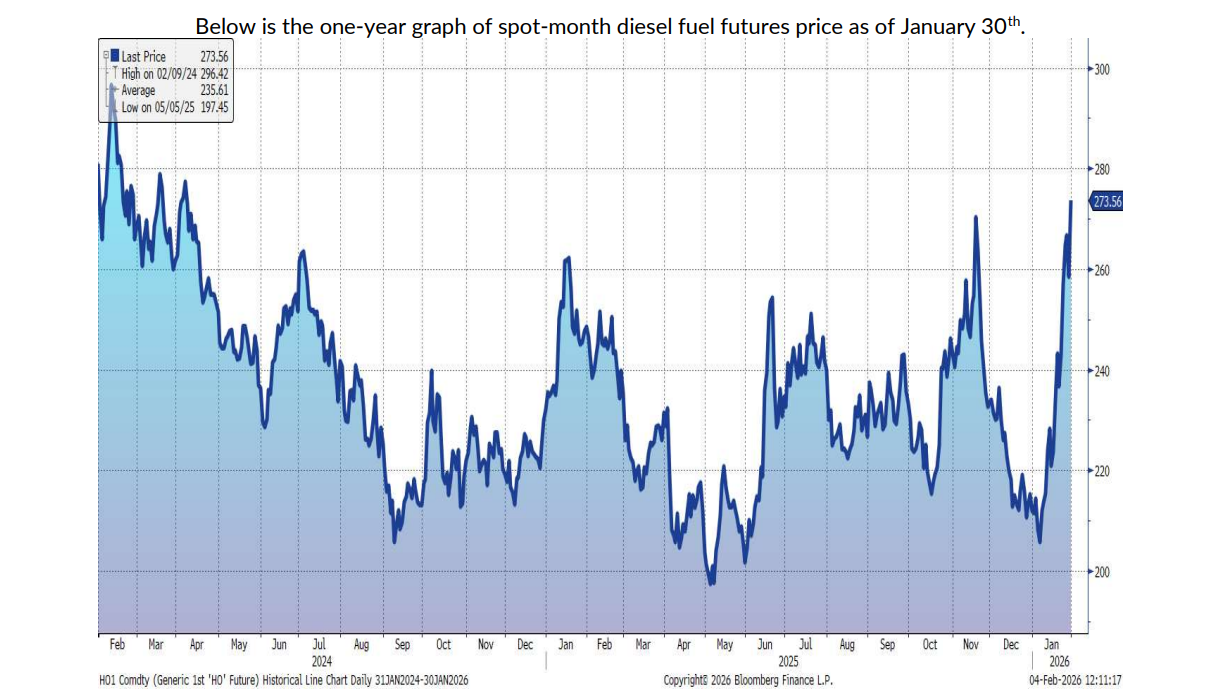

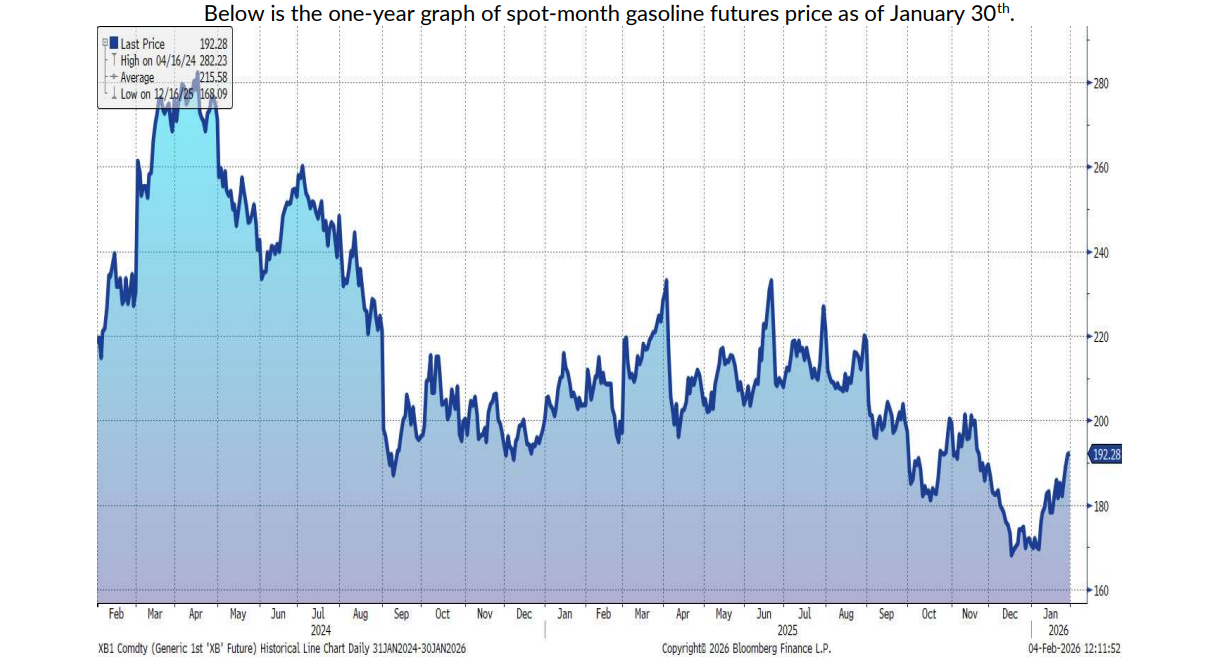

Price Movement:

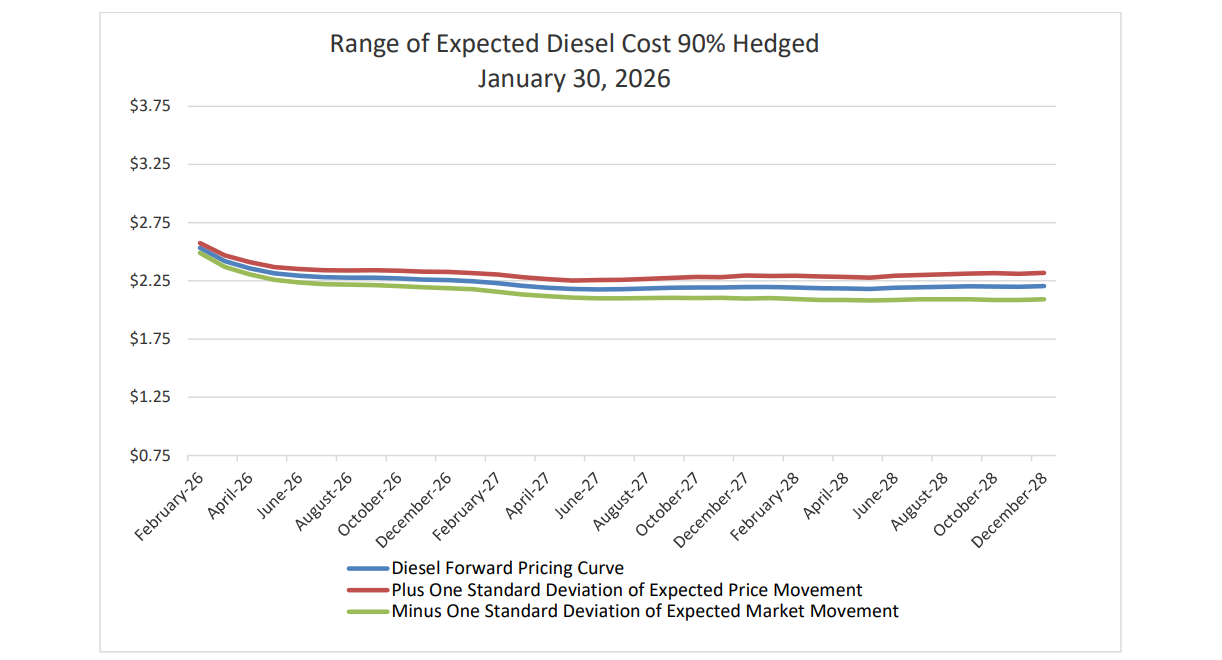

- Diesel: Increased by $0.3071 per gallon (+12.65%)

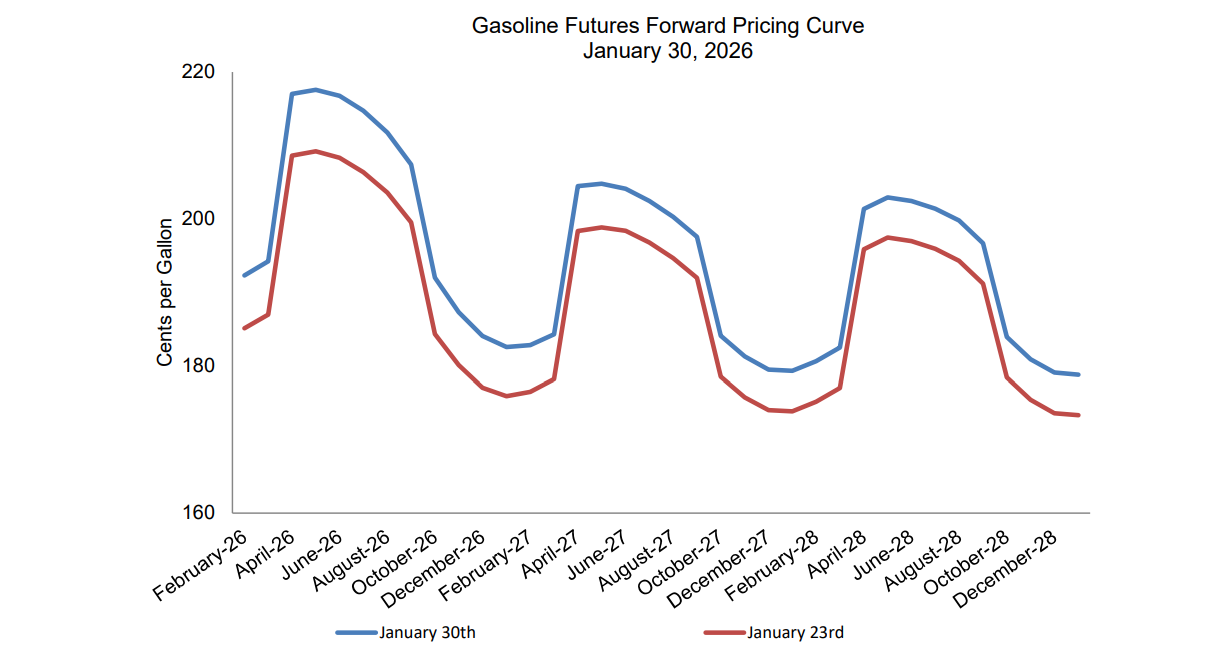

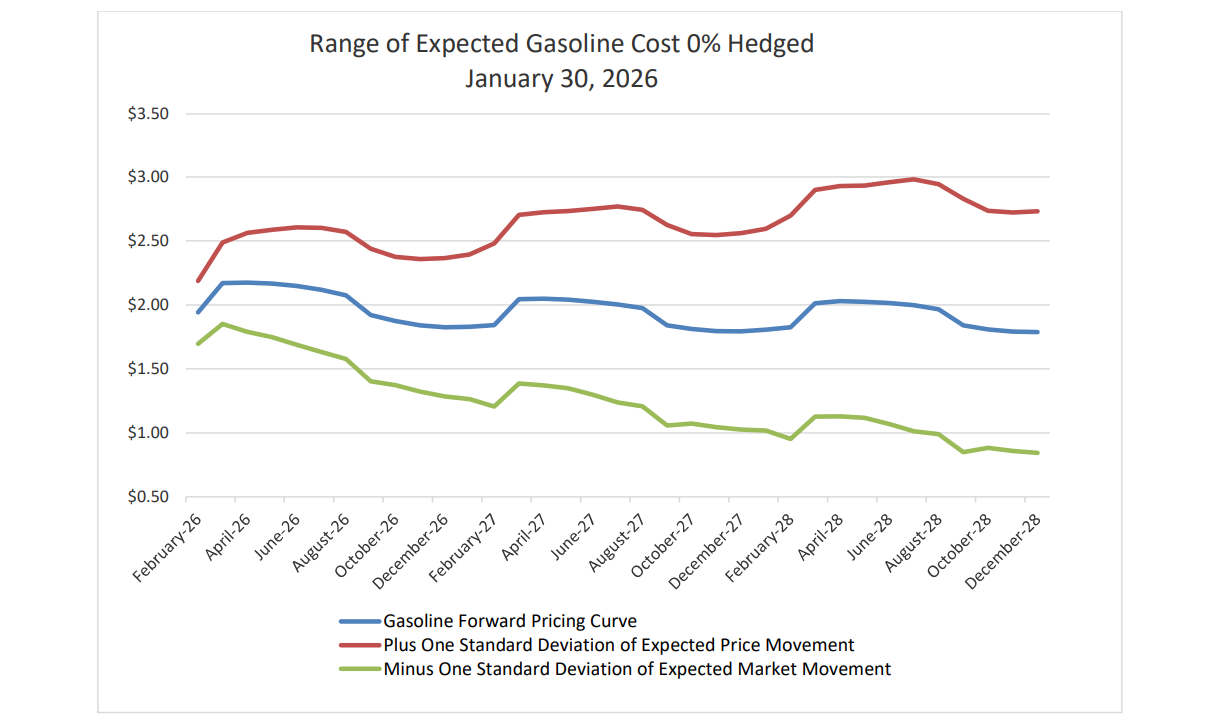

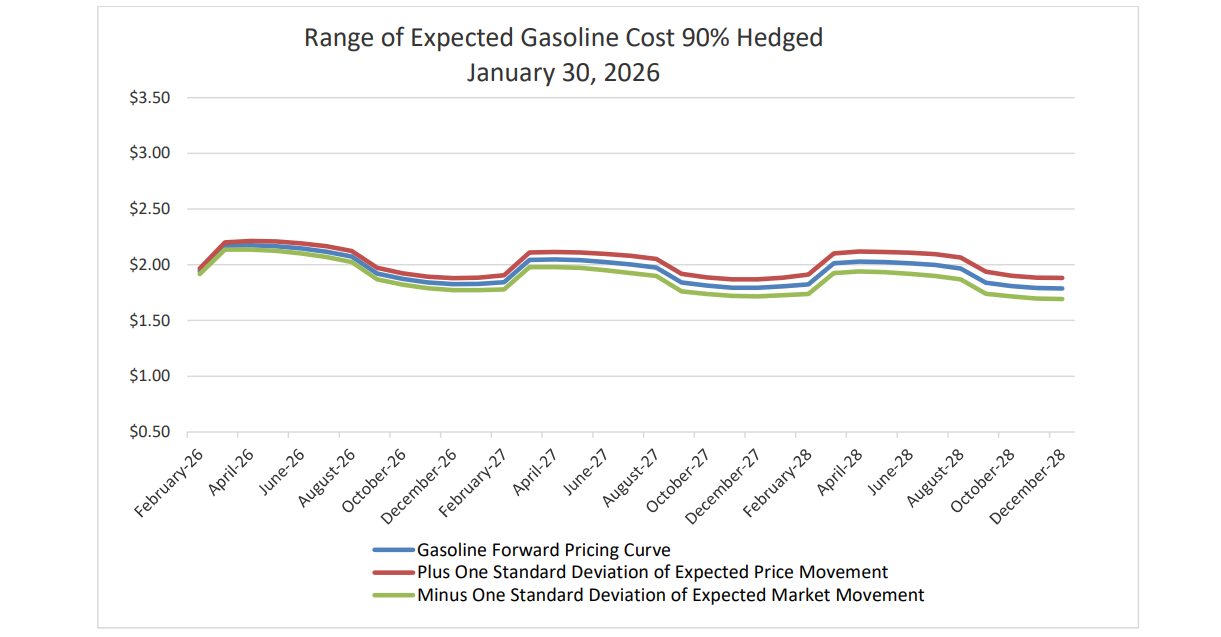

- Gasoline: Increased by $0.0718 per gallon (+3.88%)

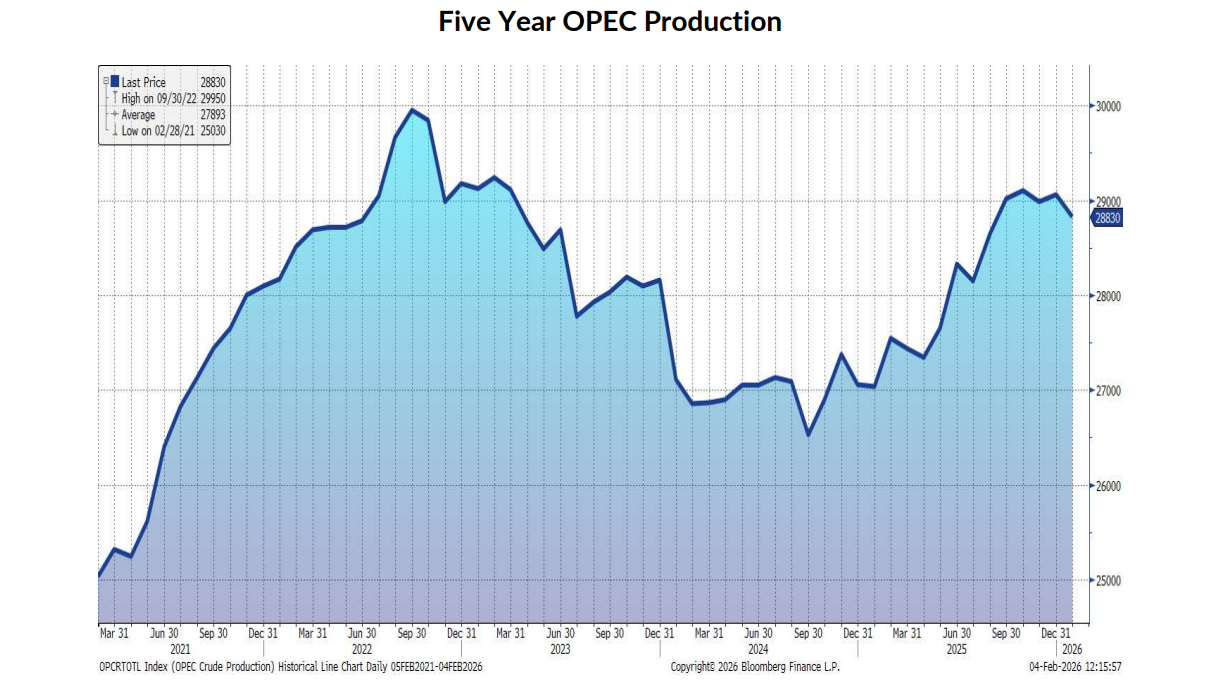

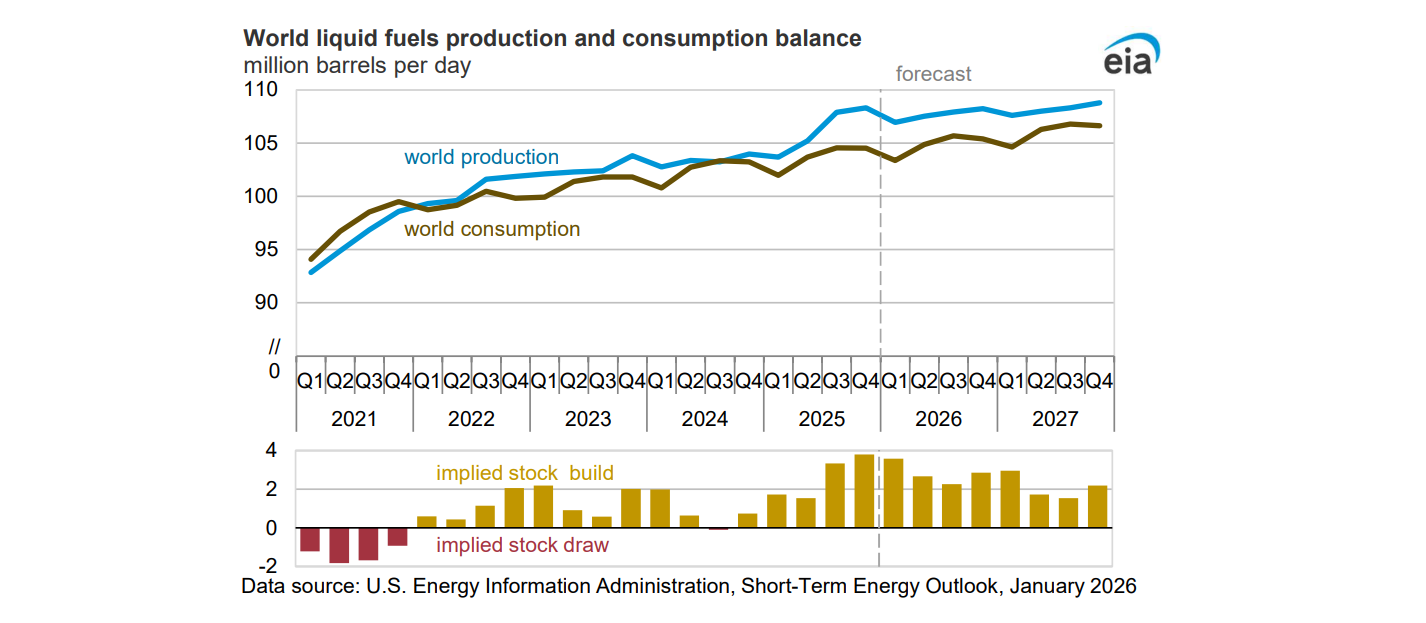

Key Drivers:

- Iran Risk: Tensions in the Persian Gulf are a major factor driving prices up, with the potential for supply disruptions.

- OPEC+ Actions: Maintaining production quotas steady through March, with a slight drop in production.

- US Imports: Increased crude oil imports from Venezuela are offsetting some of the supply risks.

- Cold Weather: Shutting in oil production in Texas and the Gulf Coast, which limits supply and increases prices.

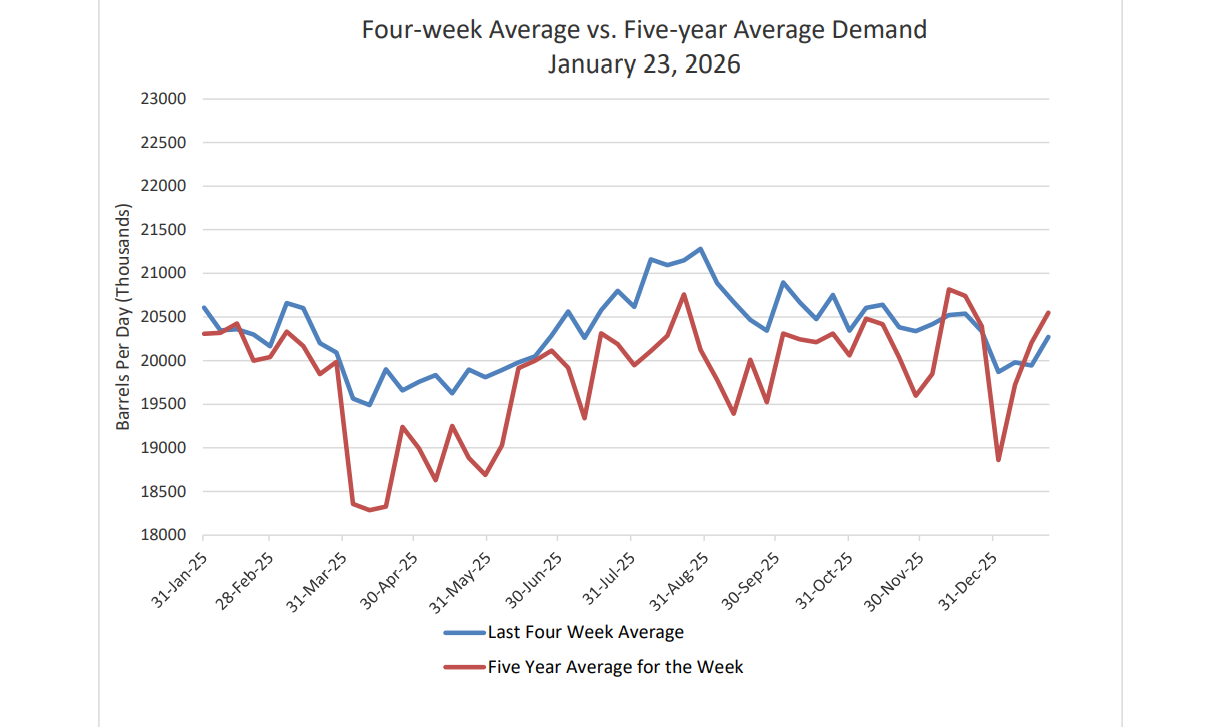

- Demand: Increased, particularly for diesel due to higher heating demand in the Northeast.

Market Indicators:

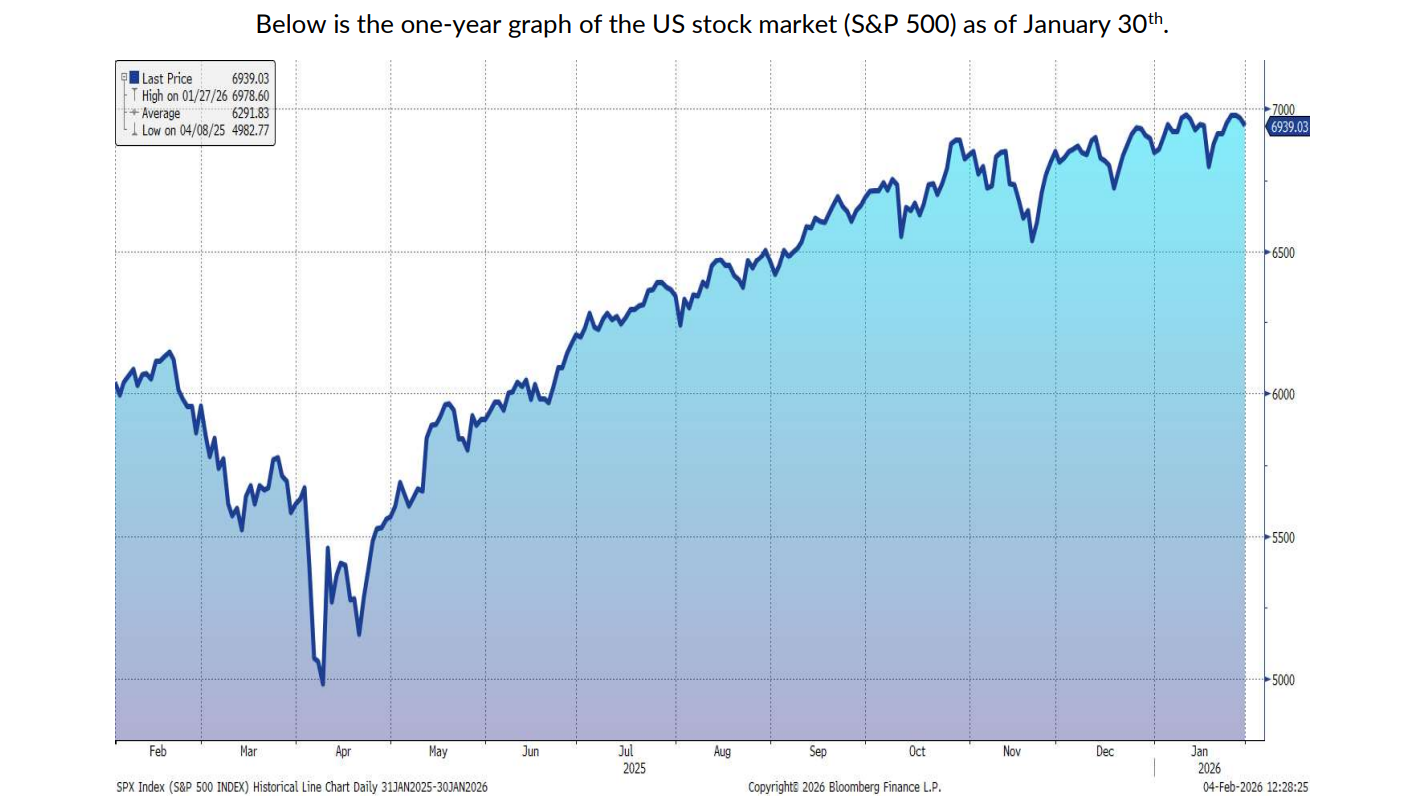

- Stock Market: Increased by +0.35%, supporting economic optimism and petroleum prices.

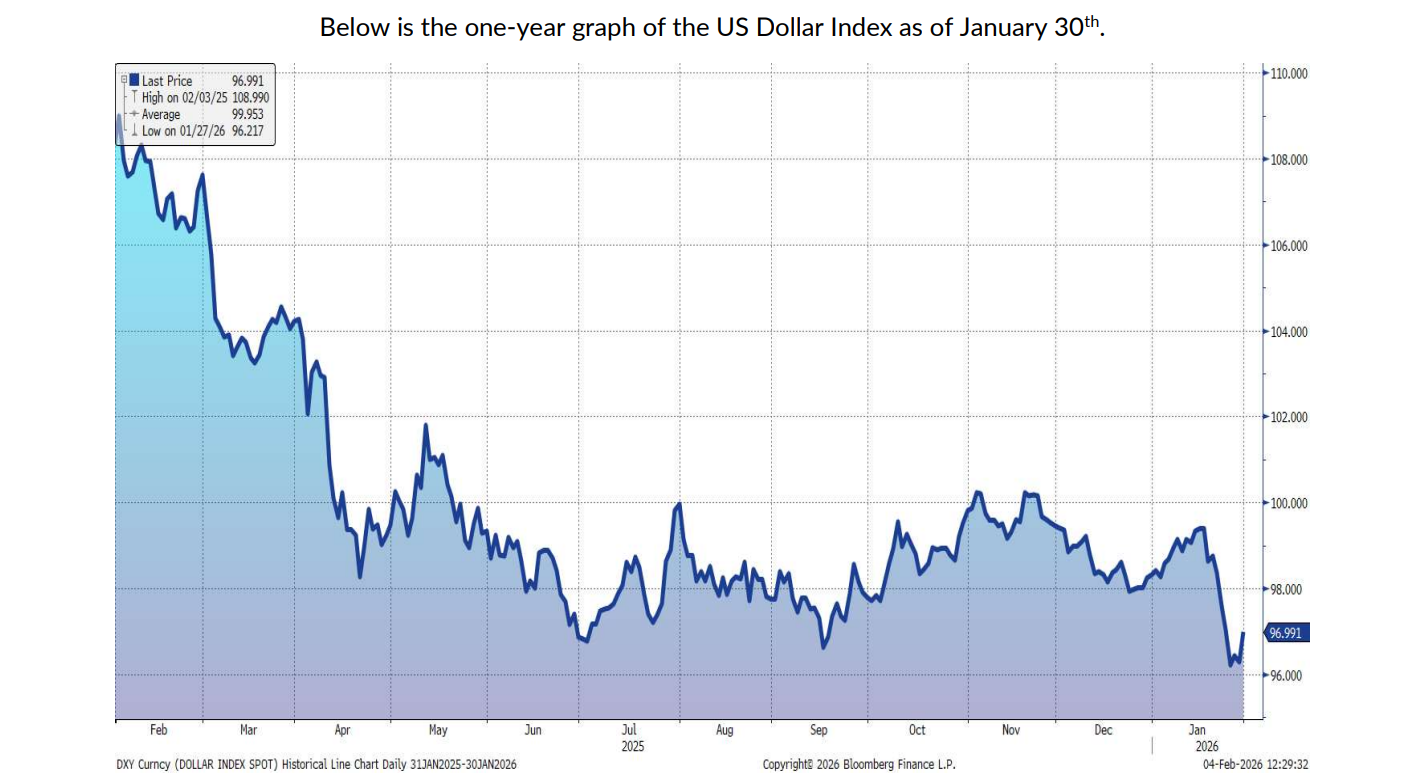

- US Dollar: Decreased by -0.62%, which is positive for petroleum prices.

- Speculation: Increased, further supporting upward price movement.

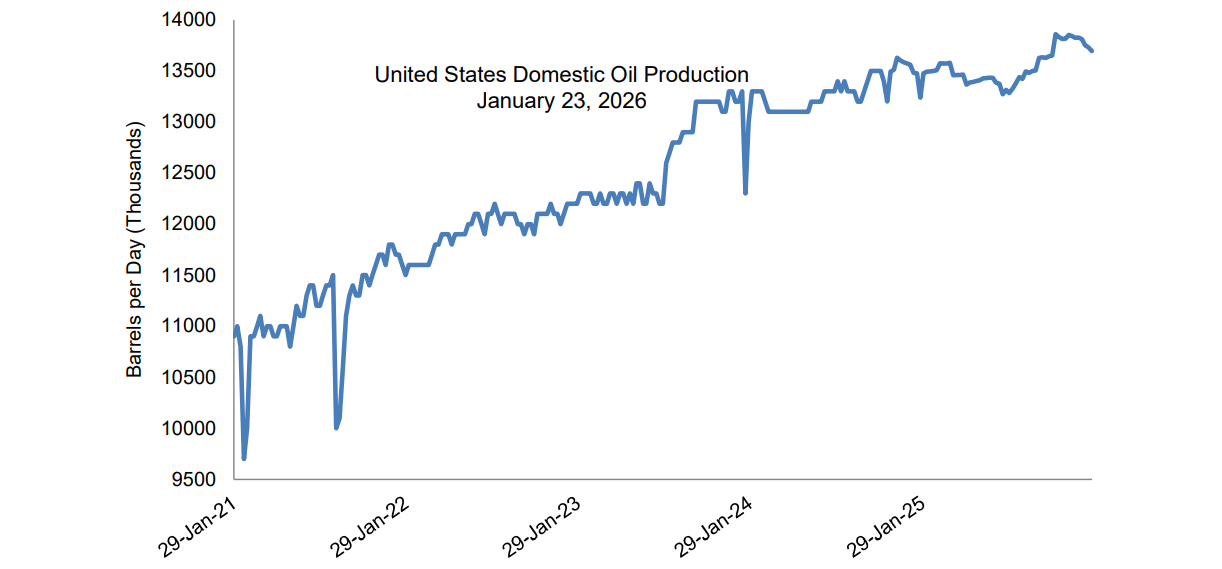

- Production: Lower by 36,000 barrels per day, which is supportive for prices.

Forecast:

- Geopolitical tensions, cold weather impacts, and rising demand will likely keep upward pressure on petroleum prices, despite some longer-term production increases.